Lumber market coming down? Not so fast….

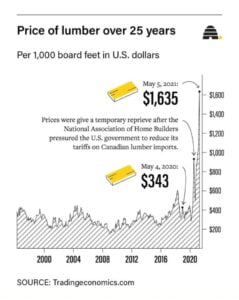

As lumber prices skyrocketed over the past year, the extreme cost of wood firmly established itself as the subject of memes and headlines across online social and news outlets. When “dead trees” become, according to Dustin Jalbert, an economist at Fastmarkets, the “hottest commodity on the Planet” (The Atlantic) and the cost of a new house goes up $36,000 because of lumber prices (CNN), people start to notice.

Articles and blogs popped up describing all the contributing factors – from decades-old beetle infestations in Canada and Europe, to COVID production curtailment, to the purchasing habits of the home-bound DIY consumer. And the factors were just as interesting as the affects were far reaching.

Historically, the wood industry has it’s ups and downs, so many are used to pricing changes over time. But what we all collectively saw over the past year caught us off guard, and put many on guard.

As the supply chain continues to be rocked across all industries, attention to trends and possible relief, anywhere, also heightens. People want to know when it’s getting better, particularly those in supply chain where a three-fold price increase on a simple, standard pallet had people second-guessing their wood suppliers.

As the supply chain continues to be rocked across all industries, attention to trends and possible relief, anywhere, also heightens. People want to know when it’s getting better, particularly those in supply chain where a three-fold price increase on a simple, standard pallet had people second-guessing their wood suppliers.

Over the last several weeks, there are signs of an oncoming softening to the market. Some people are claiming that we are already in the midst of a market “crash” (WSJ). That has many downstream wood product buyers already pushing their suppliers for relief.

While all signs do point to an oncoming cost correction, it’s not going to hit across the industry as fast as anyone wants.

Lower costs at the mills do not instantly equal instant lower costs at pallet, crate and other finished wood goods manufacturers, nor on new home construction, for that matter. It will take time for those lower cost items to start hitting inventories and trickling into the great supply chain. In addition, a supply and costing squeeze remains on wood panel and composite materials – anything that combines wood with bonding resins, as the latter is still suffering from chemical shortages that reached critical mass due to the Texas winter storms and production still has not overcome demand. As this all shakes out, different grades of lumber might flip at different times – you could see higher grade materials briefly drop below low grade, mirroring what we saw when the market started to launch. It took most of a year for lumber to reach its peak; it’s reasonable to expect some time to pass as supply shakes out.

Patience will be the game coming into the next several months – relief appears to be on the horizon, but there’ll be some zigging and zagging to get there.

To learn more about material pricing and how it’s affecting wood packaging, please reach out to our team.